“OK, let’s go. The dog’s in the car already.”

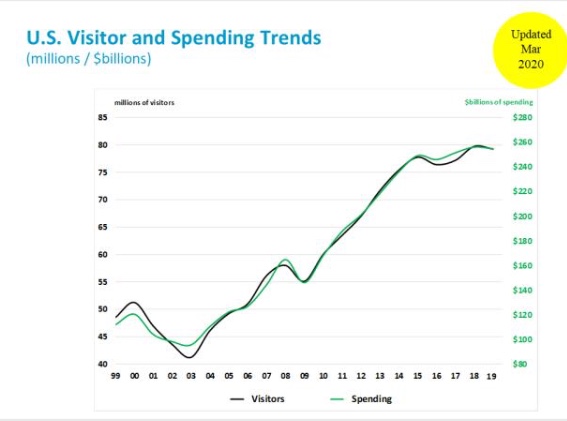

There are continuing signs of travel recovery around the world. Hotel occupancies, air load factors, attraction openings and demand generators are all on the rise as economies open up.” – MMGY Global

Knowledge is power.

Ensure your strategic planning is targeted, timely and on the right track by using all the Covid-19 travel insights you can gather, especially while so many of them are being shared for the community without cost.

Related: A Robust List of Resources and Research to Help DMOs and Their Partners

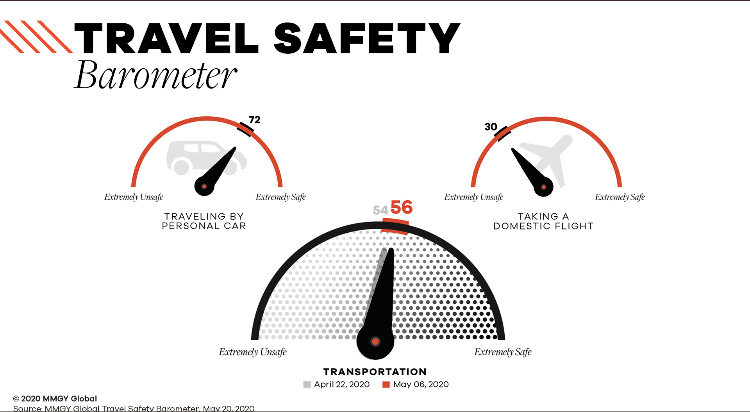

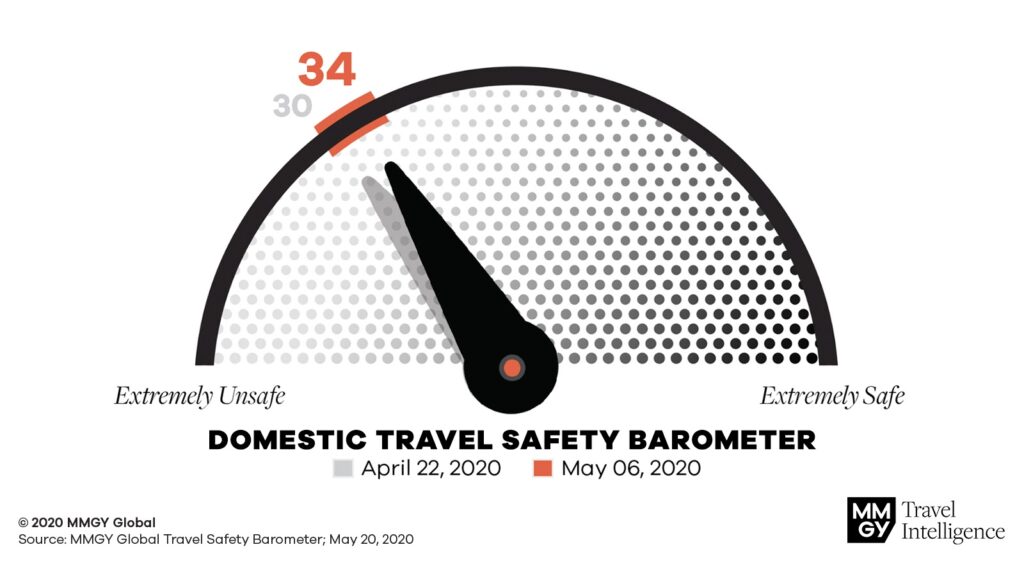

Related: Never Mind the Weather, Let’s Check the Safety. A Travel Barometer is Born

A few recent highlights and resources, plus links for getting more data:

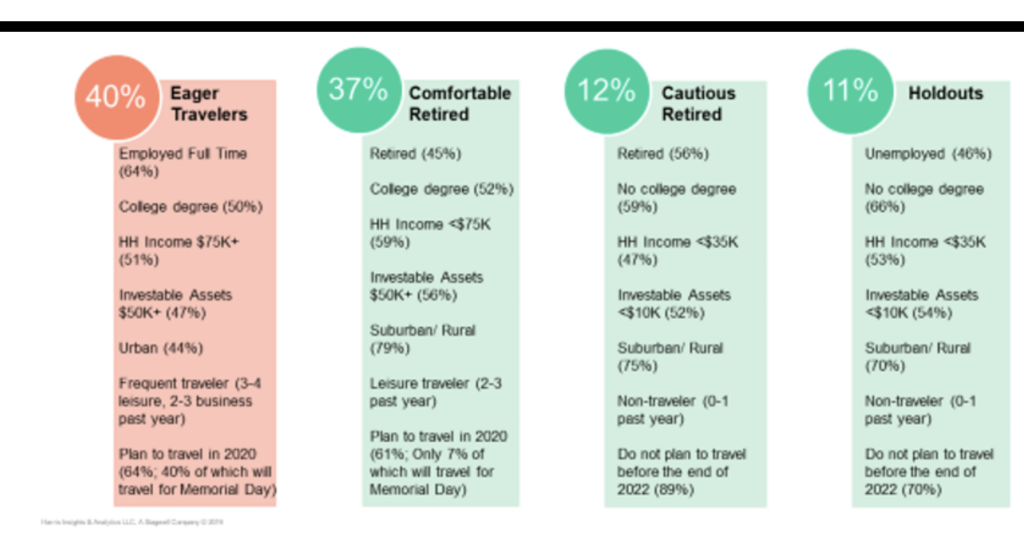

- One-in-five are now already traveling or ready to travel with no hesitations. These Americans have less concerns about the impact of the virus, and are more likely to prioritize having new experiences in their lives.

- They are also most likely to be Gen X (41-55 years old).

- Openness to travel inspiration and excitement to take a getaway in the next month jumped up this week.

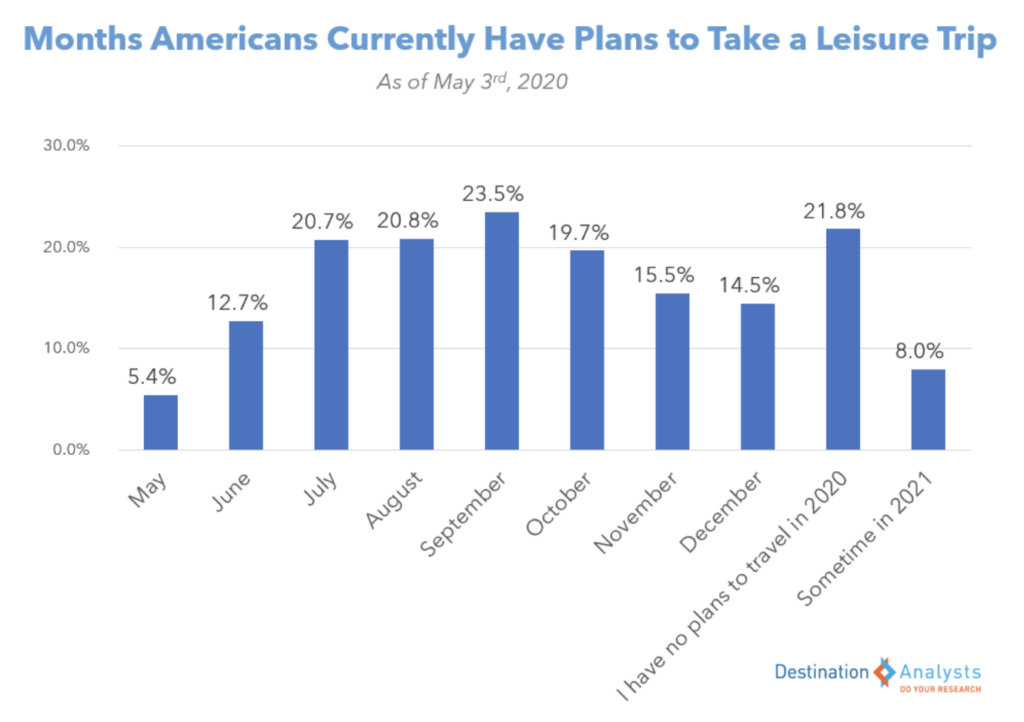

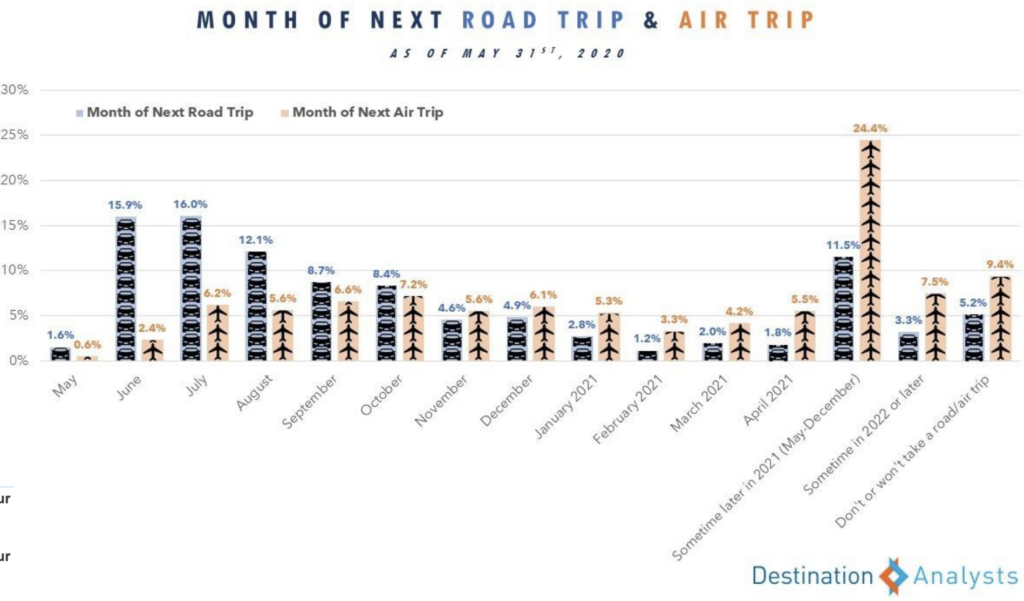

- As of May 31, Americans are feeling more inclined to take a trip sooner than they’d been reporting the week prior.

DA gathered responses from 1,257 people on May 29-31, 2020.

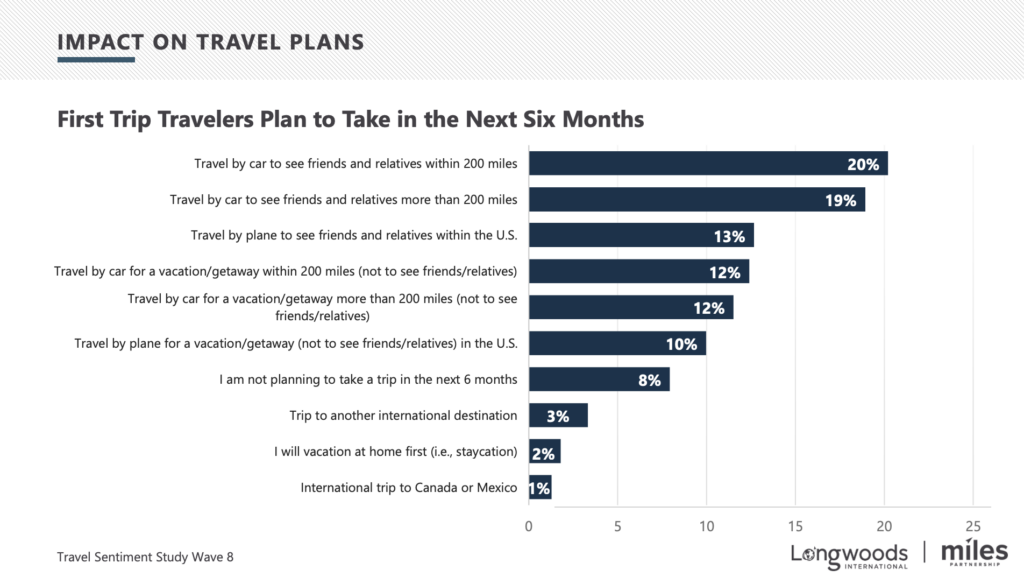

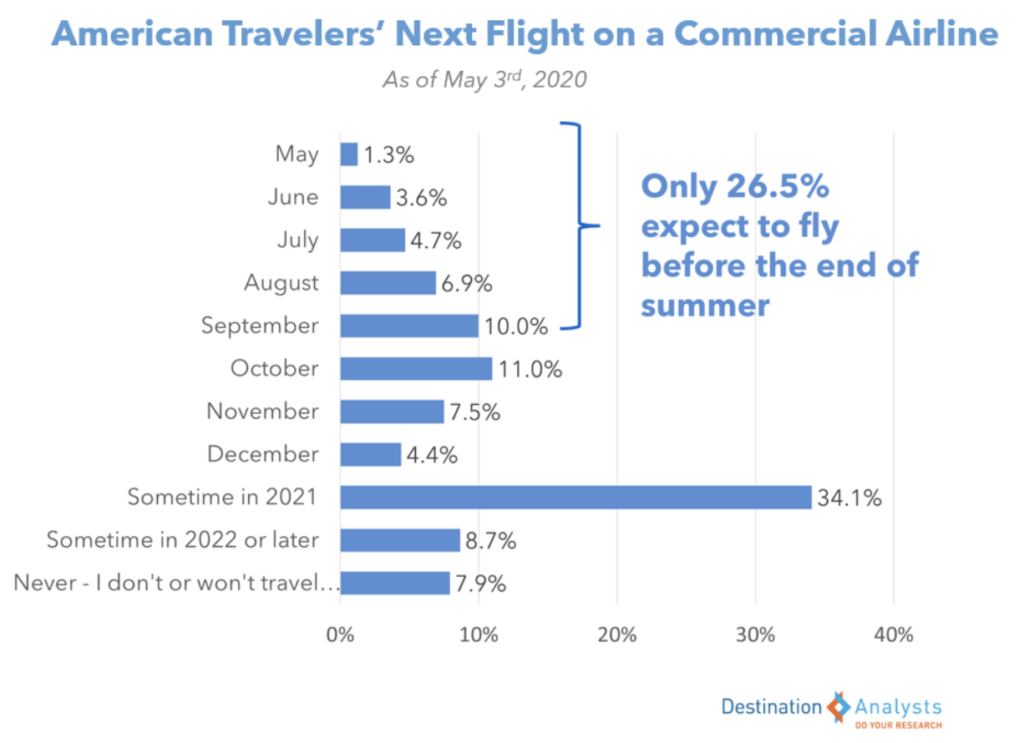

Question: In what month do you expect you will take your NEXT TRIP on a commercial airline?

Question: In what month do you expect you will take your NEXT ROAD TRIP traveling in a personal automobile?

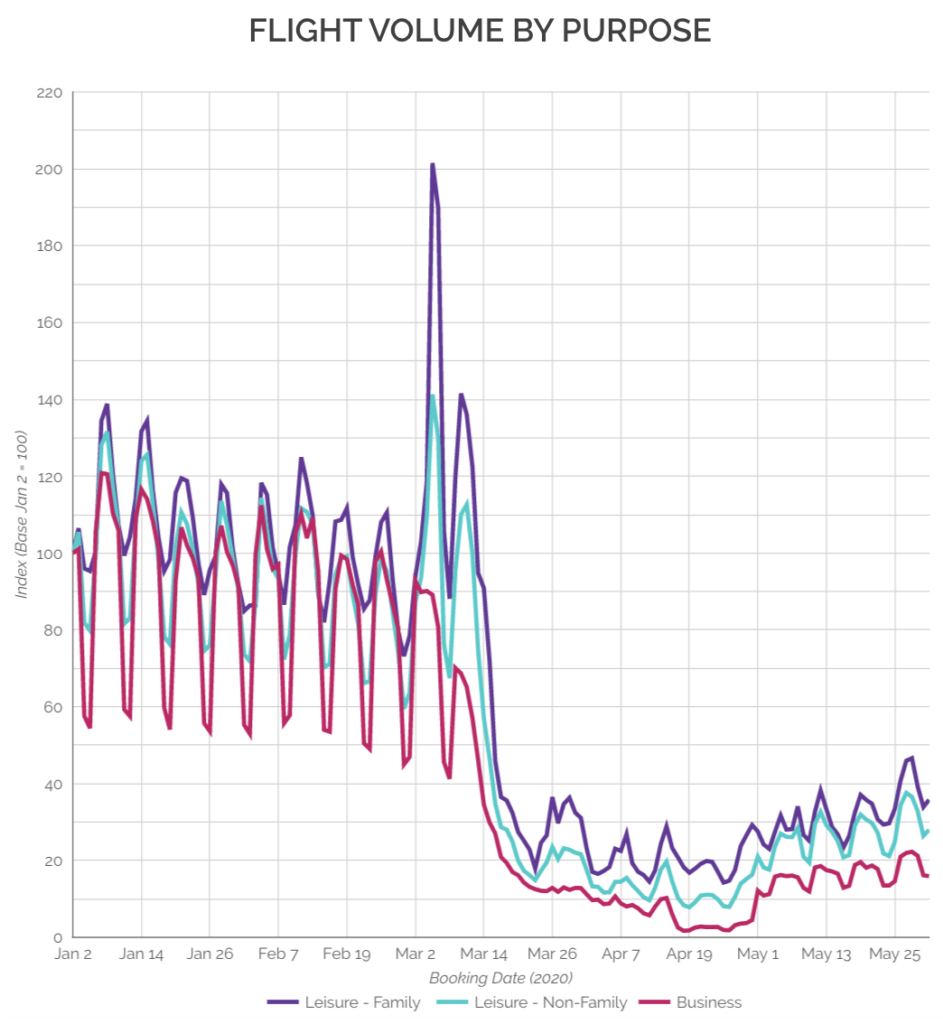

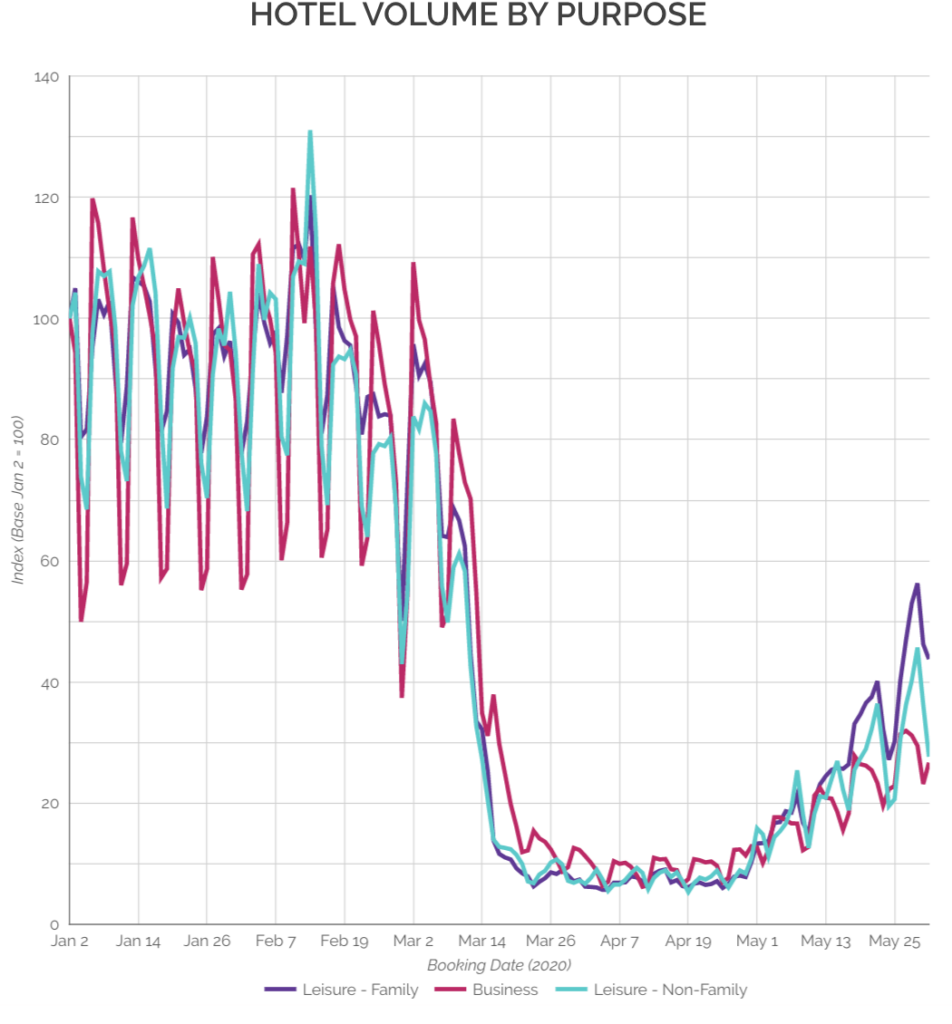

Shows 2020 travel trends tracker data on both flight and hotel volume purpose broken down into Leisure / family, Leisure / non-family, and Business:

See additional U.S. domestic travel trend tracker graphs via the Adara link above.

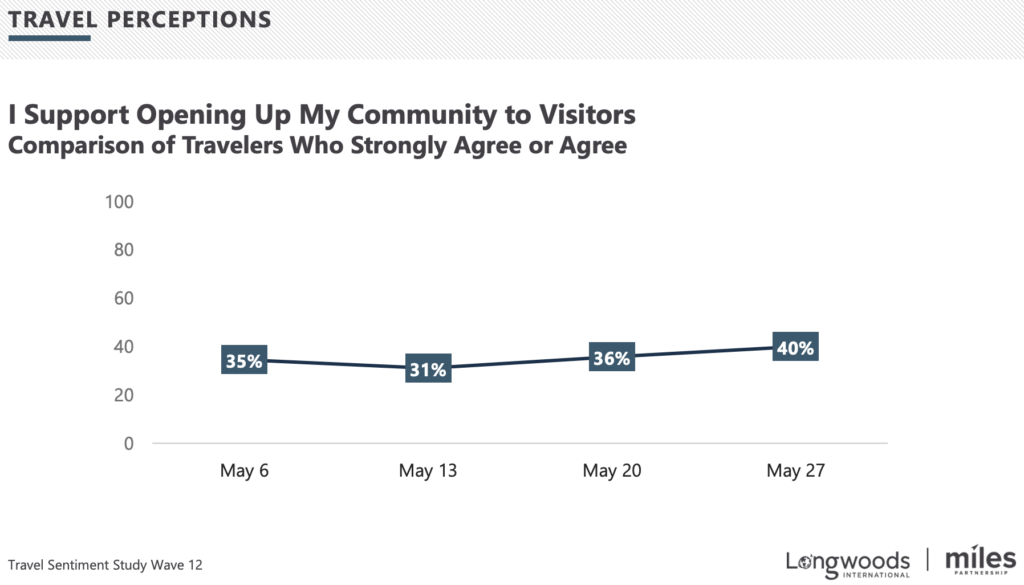

Wave 12 of the weekly consumer sentiment survey indicates that 40% of American travelers support opening their communities to visitors (up from 31% two weeks ago) and 43% would feel safe traveling outside their communities (up from 35% in that same time period).

In a national sampling of 1,000 American adults fielded during the week of May 27, respondents answer additional questions on travel perceptions and travel planning. In summary:

- 47% of American travelers say the coronavirus pandemic will greatly impact their travel plans in the next six months, down from a peak of 67% on April 1 and the lowest level since mid-March.

- Almost half of American travelers are still planning their first trip since the pandemic within the next six weeks.

- Those American travelers who have plans to travel in the next six months is still holding steady at 71%

- 40% of American travelers support opening up their communities to visitors.

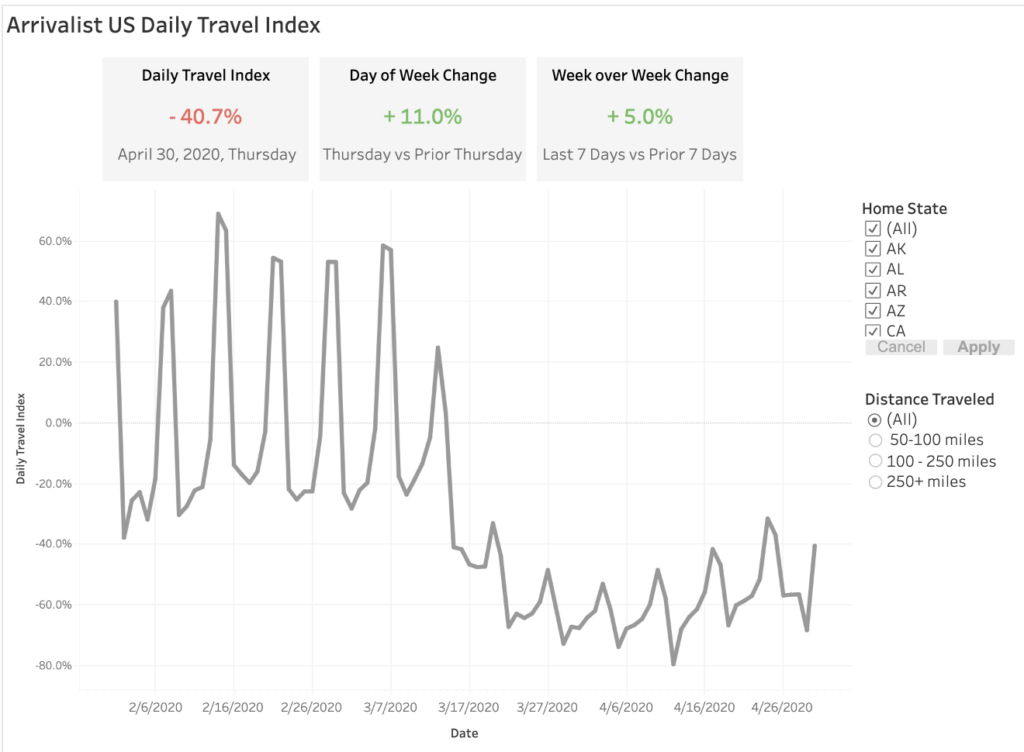

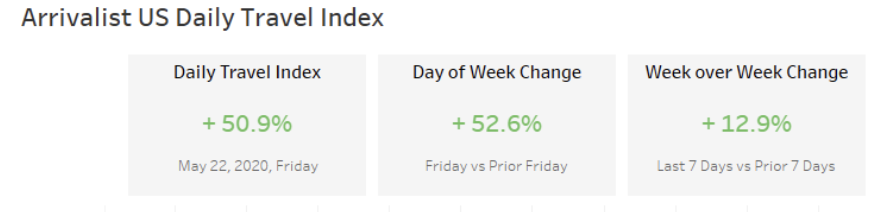

The Daily Travel Index measured a sharp increase in road trip activity over the Memorial Day Weekend. “The majority of road trips measured since COVID19 were initially in the 50-100 mile range, reflecting the hesitant nature of the U.S. consumer to travel far from home in the previous 7-8 weeks. It appeared to be the jumping-off point for American travelers with road trip activity in the mid- and long-range mileage bands (100-250+ miles) sharply increasing throughout the country.”

The data says road trips are up. Memorial Day Weekend led to a 48.5% increase in travel weekend over weekend compared to May 15-16. It was the most dramatic increase in weekend-over-weekend road trips in 2020.

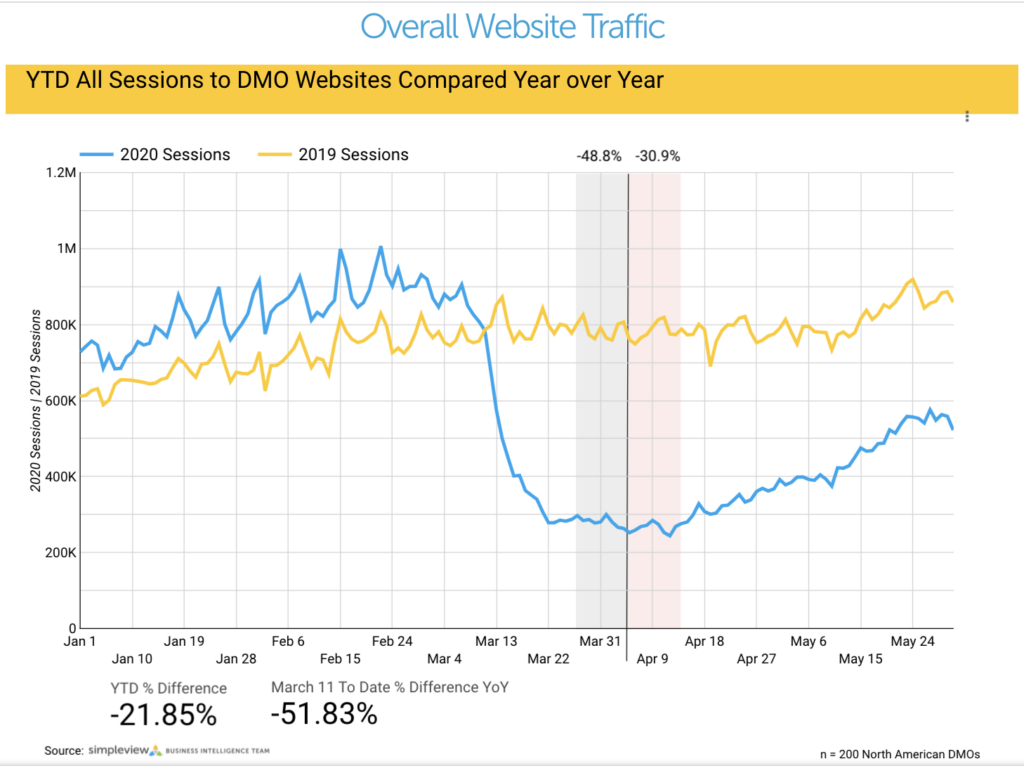

What about overall traffic to North American DMO websites? Simpleview is tracking all sessions to 200 of them for a comparison of year-over-year.

They’re also tracking the latest data and analysis on meetings leads, booked events, postponed and canceled events and other indicators for the meetings sales industry.

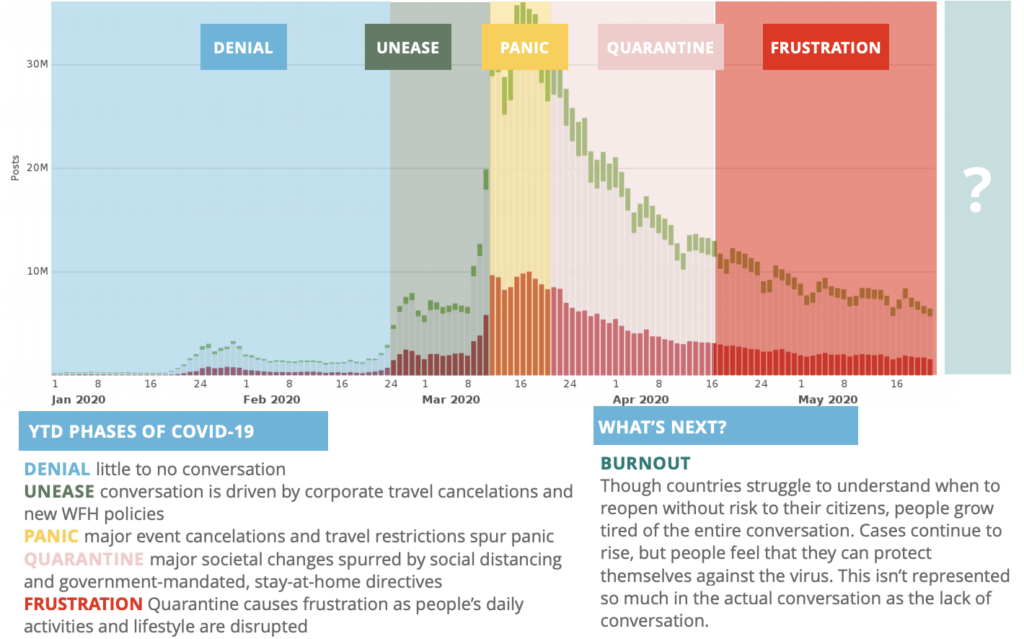

Connect with your audience. Follow the conversations Americans are having across social media channels as we move through the phases—denial, unease, panic, quarantine, frustration…

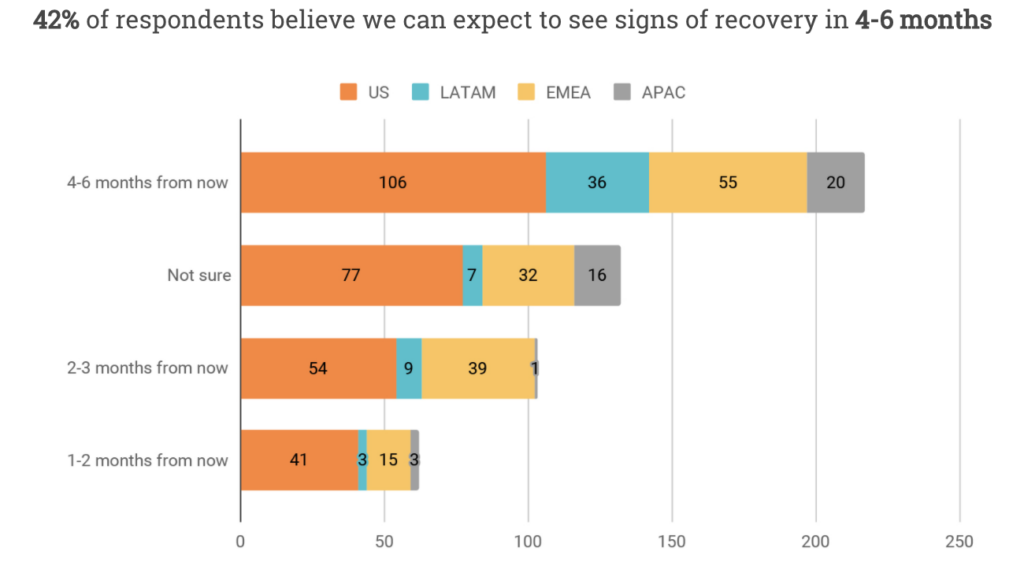

What are hoteliers thinking? A recent survey conducted of 500+ hoteliers worldwide indicates that they are aligned on key recovery post-COVID marketing strategies.

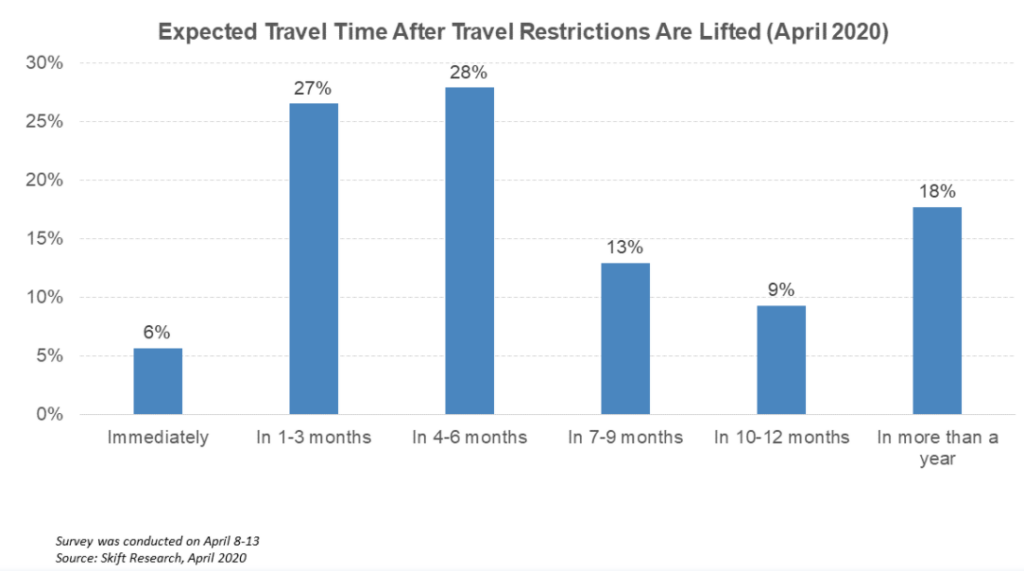

However, note that while most respondents picked 4-6 months from now, a good number of responses in the other categories indicates that recovery will come in stages and may depend on location and hotel type.