The question everybody wants answered is, when will it be SAFE to…?

As digital tourism marketers, we know the answer lies in the data. It’s important to know what people are thinking and feeling about travel in the future.

Our eTourism Community is fortunate to have access to top-rate information and weekly updates plus comments from thought leaders at these research and analytics firms.

Related: Traveler Sentiment Weekly Update & Community News

Related: “Best Interactive Maps to Track COVID-19“

>> The Harris Poll COVID-19 Tracker, Wave 6 is out now.

To stay on top of American traveler sentiment, click on the title of each report to check out these resources:

Longwoods International American Traveler Sentiment (w/ thanks to Miles Partnership for support)

“As you will see in the results of our fifth wave of this survey, we seemed to have hit a point of stabilization in a number of factors (time to turn the corner?)… and the big news is our first uptick in those travelers indicating that they plan to travel in the next six months! Now an upswing in one week does not make this a trend, but we will be watching this closely!” – Amir Eylon, President & CEO

MMGY Global

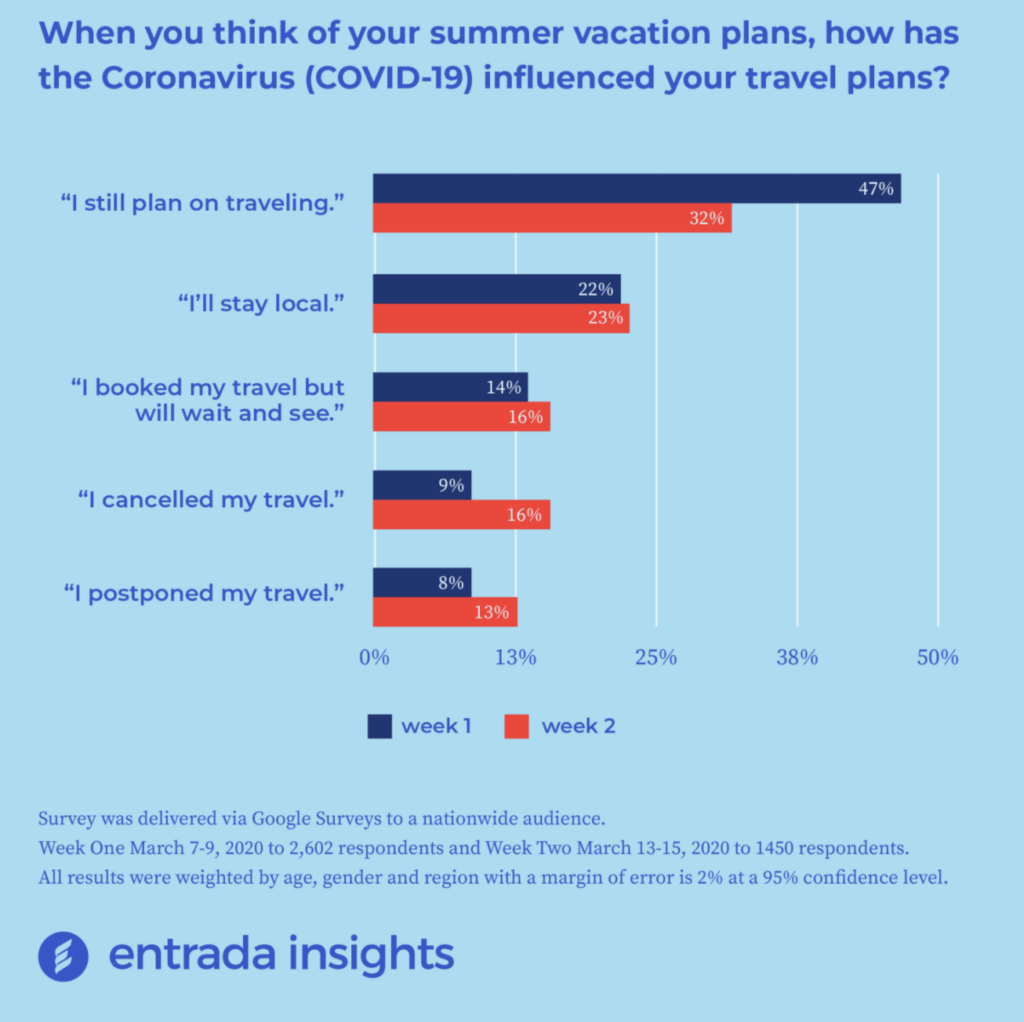

COVID-19 Travel Insight Report – April 13

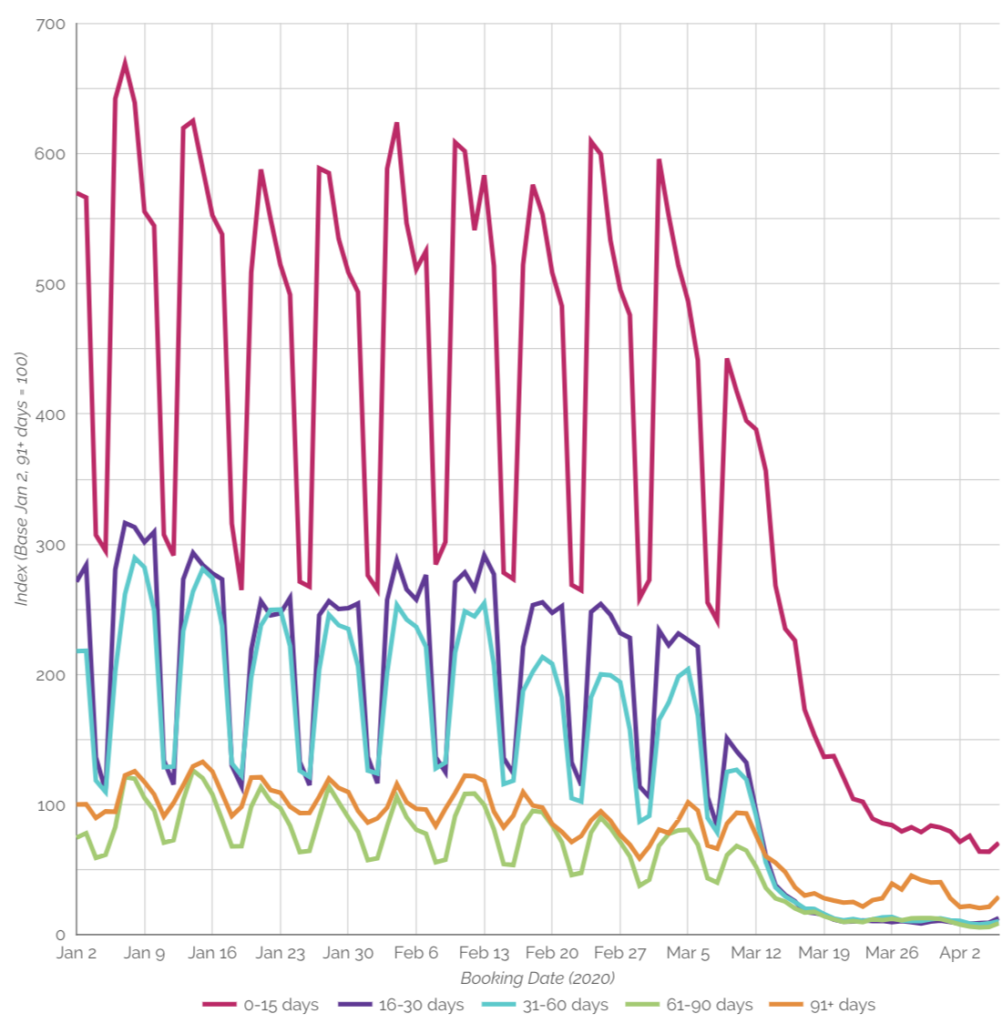

There is plenty of data to suggest that immediate bookings will be driven by more local travel and drive market trips. However, long-term strategies should not be forgotten – especially for long-haul markets where booking windows have the potential to lengthen based on safety sentiment. It will be important to sift between short-term trends and macro shifts in consumer behavior that will define the “next normal.”

Register for the Adara Traveler Trends Tracker, updated frequently, which taps into real-time travel data to track travel-related consumer behavior and identify key trends. There are also links for weekly webinars, such as COVID19 Insights Series Week 3: Inflection Detection: Discerning and Preparing for the Rebound with Tom O’Toole, Executive Director, Program for Data Analytics at Kellogg of Northwestern University and former CMO and President, MileagePlus of United Airlines and CMO of Hyatt Hotels Corporation.

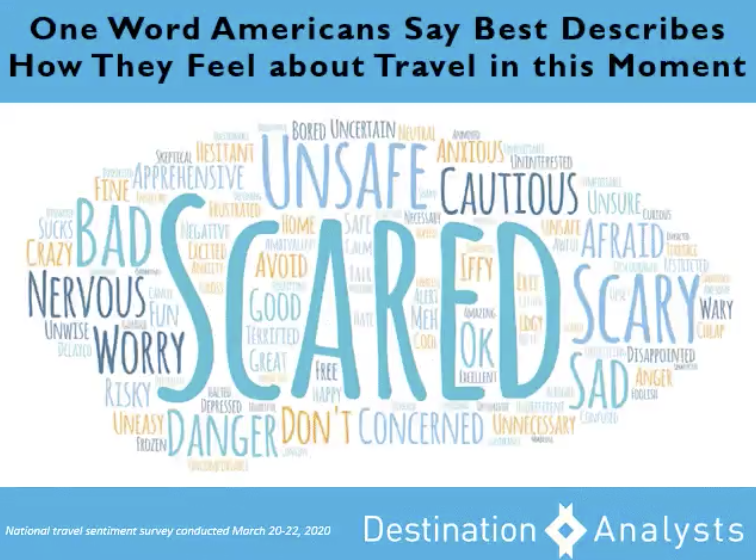

Destination Analysts

Update on Coronavirus’ Impact on American Travelers – Week of April 13

Key things to know this week about Americans + travel: They are feeling somewhat better that the worst of #covid19 in the U.S. will soon be over. But while nearly 70 percent continue to say they miss travel, the vast majority say they will approach travel with at least some trepidation when they start again. It will not be a simple return to pre-pandemic sentiments and behaviors—nearly 40% now say they will change the types of destinations they choose to visit, half say they will be avoiding anywhere crowded, there is a growing number who will take a staycation this summer, and younger travelers are increasingly saying they will take more road trips to avoid air travel. When asked the place they will visit on their first trip when coronavirus is over, beach/resort destinations top the list, followed by small towns/rural areas.

Arrivalist

Daily Travel Index

Measures consumer road trips of 50 miles or more by residents from all 50 U.S. states. The data is drawn from a panel of GPS signals representing consumer road trips taken by car. Updated approximately every 48 hours.

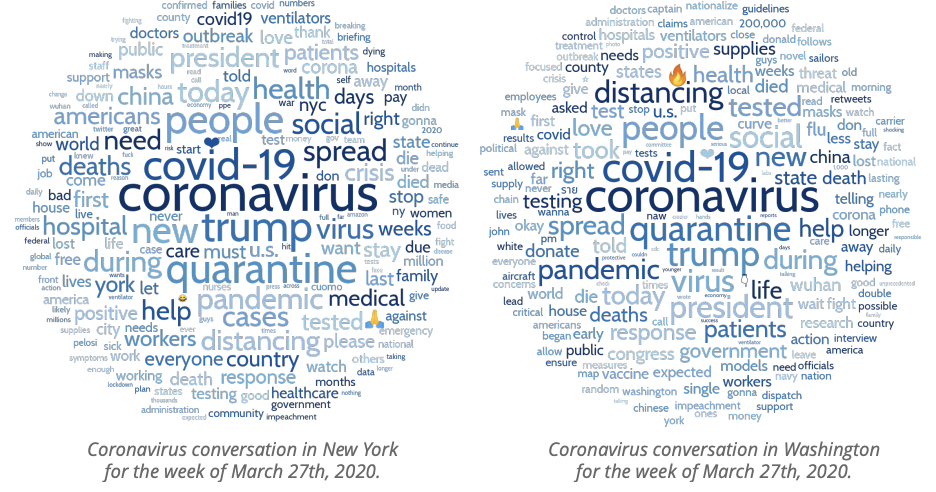

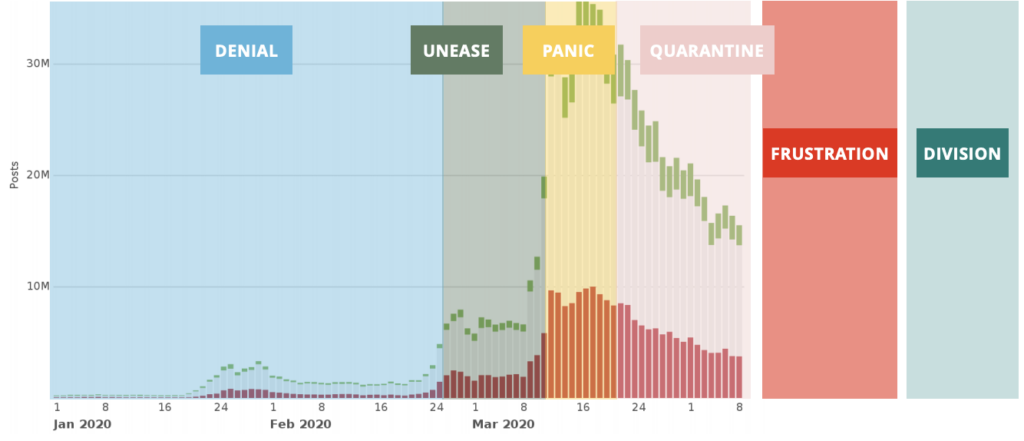

Sparkloft Media

Weekly COVID-19 Sentiment Review

State-of-the-art machine learning and a proprietary process to analyze what social media users are saying about the coronavirus on a daily basis, generating insights and recommendations are generated. Sign-up for the free weekly report.

Simpleview

Data Report: Impact of COVID-19 on Destination Marketing Web Traffic

This dashboard offers insight into impact at the industry level. The reporting compares 2019 and 2020 Google Analytics data for 200 DMO websites across North America. It looks at web traffic overall and filtered for organic traffic vs. traffic driven by paid media (“paid traffic”).