Quick takeaways from the week that was … Airports, hotels, industry and traveler sentiment

TSA PASSENGER TRAFFIC HIGHEST SINCE MARCH 2020

“On Sunday, March 21, more than 1.5 million people streamed through U.S. airport security checkpoints, the largest number since the pandemic tightened its grip on the United States more than a year ago.

It marked the 11th straight day that the Transportation Security Administration screened more than 1 million people, likely from a combination of spring break travel and more people becoming vaccinated against COVID-19.” — Associated Press

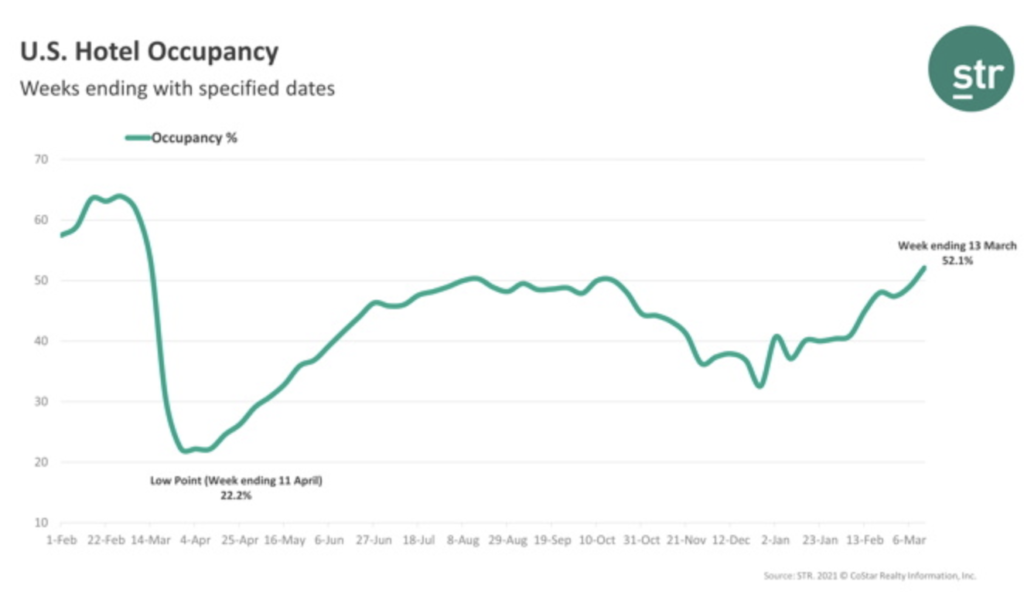

HOTELS SHOWING SIGNS OF LIFE

U.S. hotels are optimistically preparing for a surge in demand as occupancy rates reached 52% nationwide last week, the highest level in a year since Covid-19 lockdowns began. — STR

“Florida, lifted by Spring Break and Bike Week, was most represented among the leaders in week-to-week occupancy gains. Among all STR-defined markets, Daytona Beach; Gatlinburg, TN; Myrtle Beach; San Antonio; Greensboro, NC; and the Florida Panhandle showed double-digit growth from the previous week, which is reflective of further reopening around the country. All but seven states saw week-over-week gains, and six states saw occupancy increase by more than 5 percentage points.

Among the Top 25 Markets, Tampa experienced the highest occupancy level (72.7%). The lowest among Top 25 occupancy levels came in Boston (33.6%) and Minneapolis (33.9%).” — HotelNewsResource.com

Related: Revenge Travel Is Coming: Farther and Longer, But Costlier

U.S. TRAVEL GROUPS PUSH FOR A GLOBAL RESTART

U.S. Travel Association is among 26 travel organizations signing a letter requesting the Biden Administration set a May 1 deadline for lifting restrictions on inbound international travel.

In 2020, international arrivals to the U.S. fell 62% from Mexico versus the previous year, 77% from Canada, and a whopping 81% from overseas markets—for a total loss to the U.S. economy of $146 billion last year.

The significant decline in that travel segment is a big reason why travel’s total economic output in the U.S. declined by more than a trillion dollars in 2020, with 5.6 million travel-supported jobs lost—65% of all U.S. jobs lost last year.

If nothing is done to lift international travel bans and bring back demand, the U.S. Travel Association estimates that a total of a 1.1 million American jobs will not be restored and $262 billion in export spending will be lost by the end of 2021.

However, if travel from the top inbound markets to the U.S is able to safely resume by July 4, 2021 and reach an average of 40% of 2019 levels for the remainder this year, it would accelerate economic recovery by adding $30 billion in incremental spending and bringing back 225,000 American jobs.

TRAVELER SURVEYS: MIX OF OPTIMISM AND ANXIETY

Traveler sentiment during the pandemic hit a new milestone, but concerns are still significant, says Amir Eylon, President & CEO of Longwoods International. “Thus… DO NOT roll back your protocols too quickly, once allowed, nor should you or your stakeholders stop promoting the extra steps you are taking to keep your visitors and communities as safe as possible.”

The latest survey fielded March 17, 2021 shows these key findings:

- 87% of American travelers reported having travel plans in the next six months – This indicator is now back to the same level we saw in our very first wave of this survey in early March of 2020.

- 33% of American travelers say COVID would greatly impact travel plans – Its lowest point since survey began.

- 52% of Americans now say they support of welcoming visitors back. This is the first time in the Covid-era that it has gone above 50%. Traveling outside their community and dining and shopping locally are both at the highest points.

- Almost half of American travelers report that clear health and safety protocols, and especially mask and distancing requirements are still very important to them when choosing their destination.

Destination Analysts invites you to register for a webinar on 14 key international markets on April 1 at 12 noon PT.

On the domestic front, independent survey results fielded on March 19-21, 2021 indicate that there is some anxiety based on recent headlines: New Covid variants, uncertainty on the current Covid vaccines’ effectiveness with such variants, a European wave of lockdowns, and and Spring Break rowdiness leading to curfews.

Key findings:

- Among the 46.1% of American travelers who report they would be happy to see an ad promoting tourism to their town of residence, by far the most common reason for this is that it would help local businesses (64.8%).

- 38.3% of those on the receiving end of a stimulus check say they are likely to spend some portion of it on leisure travel. This is even more prevalent among Millennial age travelers, who are twice as likely as Boomer travelers to spend stimulus money on travel.

- With nearly two-thirds in a ready-to-travel mindset and highly open to travel inspiration, a 2021 record-high 73.8% of American travelers did some travel planning and dreaming in the last week alone. 15.8% said they made a travel reservation in the last week.

- In each of the months from May through October, over 20% of American travelers report having at least tentative trip plans.

- As Americans are feeling far safer with travel than they were just a few months ago, they are now including air travel in their plans. Currently, 43.9% of air travelers deem commercial airlines as safe. Over 45% of air travelers say their next flight will be by the end of summer.

- Despite feeling safer and increasingly more positive, many Americans do expect a longer-term impact from the pandemic on their travel. Nearly 60% agree that the pandemic has changed their outlook on life overall, with over 20% saying significantly. As a result, 46.9% agree they will put more effort into visiting places on their travel bucket list in the next few years.

- Many in the travel industry have pondered a more permanent tie to public health—they may be on to something as nearly three-quarters of American travelers agree they will be more safety-conscious while traveling.

- When asked if the pandemic had changed their opinions about the types of destinations they want to visit for leisure in the future, 41.8% of American travelers said yes. 52.2% of Americans agree they will be visiting outdoor-oriented destinations more. Urban, entertainment and theme park-focused destinations will face greater challenges in the recovery, as 44.6% of American travelers report they are less likely to visit these places in the next few years.

- Still, about four-in-ten American travelers expect they will be sticking closer to home and spending less on their leisure travel in the coming years.

Leave a Reply