Following last week’s earnings calls, what Marriott and Hilton are saying, plus reports on airline throughout from TSA, road trips from Arrivalist, recovery insights from U.S. Travel Association via Tourism Economics, and American traveler sentiment—including concerns about the pandemic, gas prices, and inflation—from Destination Analysts.

“We think the summer is going to be gangbusters for travel demand,” said Marriott CEO Tony Capuano in a CNBC interview. “We see extraordinarily strong leisure demand…but I think what gives us continued optimism is the recovery we’re seeing in the other two segments, in groups certainly but also in business transient.”

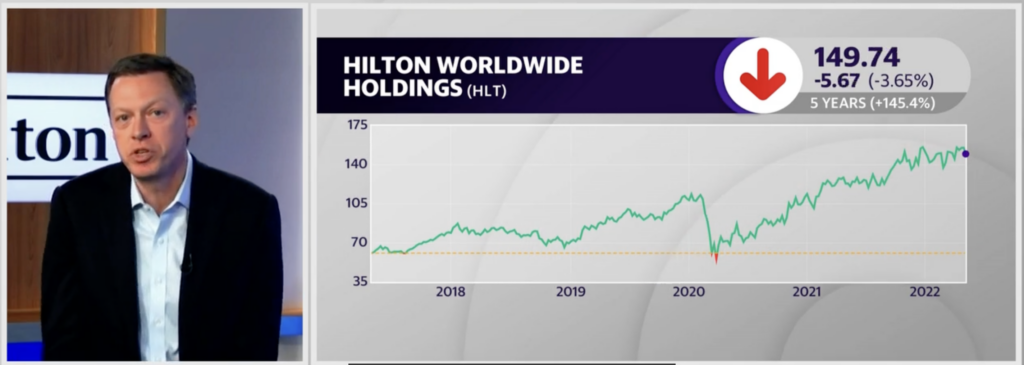

“We think this summer is going to be—after setting records in our business for travel demand and revenue last summer—we think this summer is going to be another sort of all-time record,” Hilton Worldwide CFO Kevin Jacobs said last week. Business travel will fully recover “by the end of the year,” he added in an interview with Yahoo Finance.

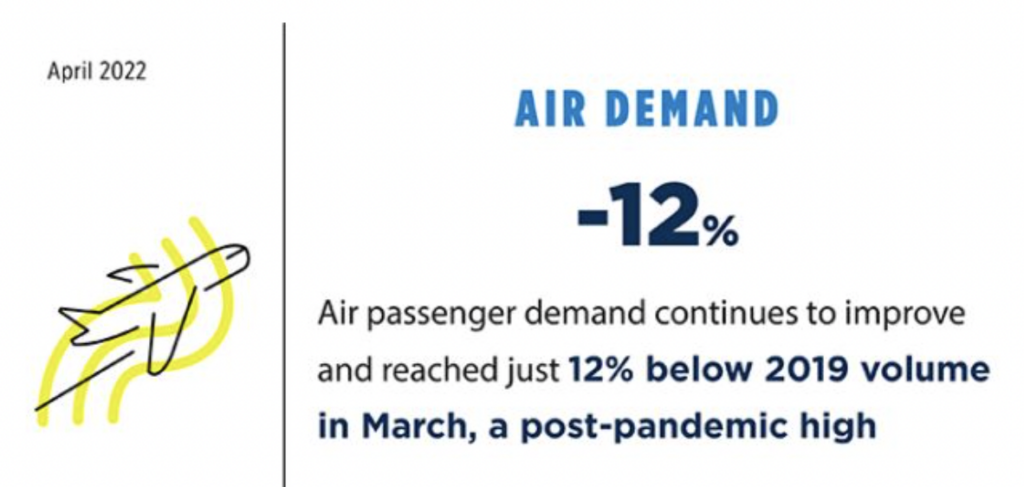

Have you seen the TSA throughput numbers? (Not to mention airfares!) In both March and April, the Transportation Security Administration screened an average of more than two million travelers at U.S. airport security checkpoints every day. These figures are only slightly below 2019.

But there are issues. Airline Weekly reports, “The recovery was looking good until a laundry list of non-pandemic issues got in the way. With results in from almost every major U.S. airline, the outlook is both bright and dim: Profits are set to return at most in the second quarter and continue through the rest of the year, but operations will be hamstrung by everything from staffing to rocket launches at Cape Canaveral. And the staffing concerns are not just with pilots. They range from crew training backlogs to competition for entry-level employees, and even air traffic controllers.”

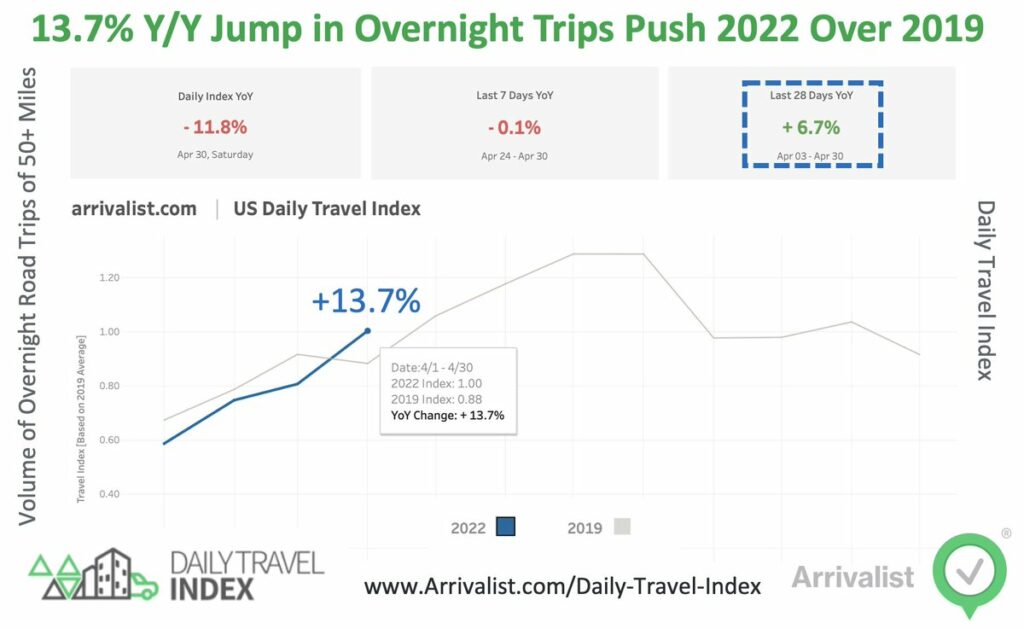

Over Easter, U.S. travelers hit the road in numbers not seen in four years, according to Arrivalist. Last week, they reported good news, “U.S. overnight road trips jumped up 13.7% from the same week in 2019, good enough to push overnight trending up 6.7% from the 2019 and up 11% from this time last year.”

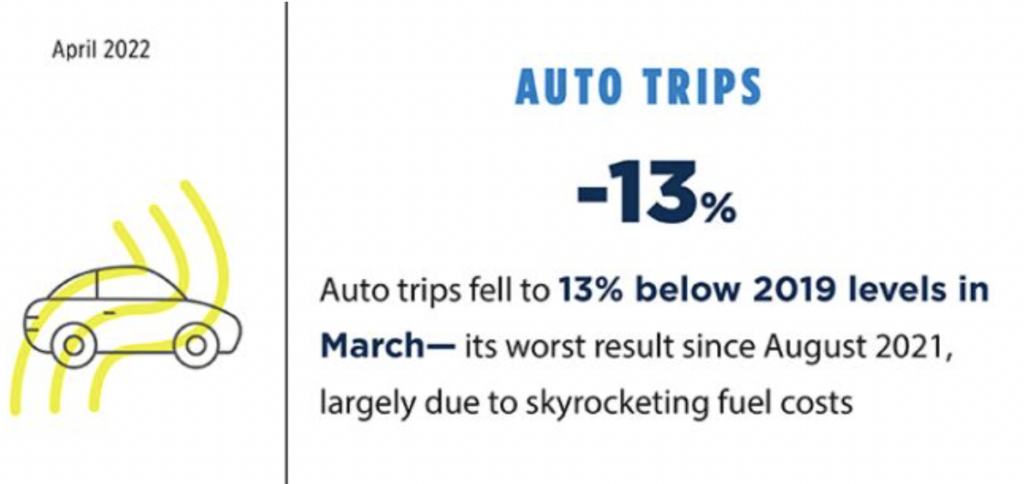

About six in 10 Americans are planning at least one summer trip. Despite higher gas prices, of those planning vacations, 35% expect to travel more this summer than last, according to the monthly Travel Recovery Insights Dashboard from U.S. Travel Association. However, nearly two-thirds of American travelers (63%) say rising gas prices will impact their decision to travel in the next six months. Data from 20+ partners is compiled by Tourism Economics.

What do American travelers think about inflation, gas prices, COVID, and going back to the office? Here’s a comprehensive update for May 2022 from Destination Analysts.

The Impact of Inflation, Gas Prices & Other Economic Factors on Travel

- Many Americans seem to feel economic headwinds are inevitable. Right now, 59.0% of American travelers believe it is likely an economic recession will begin in the U.S. this year. Just 27.8% believe inflation will weaken this year and just 24.2% believe the U.S. will experience strong economic growth.

- Inflation in consumer prices has led 23.2% of American travelers to cancel an upcoming trip, while 38.3% of American travelers agree that high prices have kept them from traveling in the past month.

- If gasoline prices don’t come down, 58.0% of American travelers predict they will be taking fewer road trips this Spring and Summer, and 60.4% predict they will be staying closer to home on their road trips.

- Fewer American travelers are now saying that luxury travel experiences are important to their leisure trips (35.6% down from 40.0% last month). While the average reported leisure travel budget for the next 12 months is at $3,857, this is still down from February, when it was at $4,283.

- Americans feeling that the present is a good time to spend on travel is at 31.8%, a 10-point decline since the start of the year.

- Nevertheless, Americans are still prioritizing their leisure travel. Nearly 90% have trips planned—3.0 on average. And despite the economic concerns, 60.6% continue to say their leisure travel is a high priority in their budget for the next 3 months. Americans recorded another record level of excitement about their leisure travel, as well. Over 80% did some trip dreaming and planning just in the last week alone.

- While down slightly from the start of the year, many Americans also continue to feel optimistic about their financial future. 42.4% believe they will be better off financially next year compared to now.

Expectations for the Pandemic

- More than half of American travelers—and over 60% of those Millennial or Gen Z age—feel largely that there is normalcy, a 20+ point climb from the start of the year.

- Now only one-third of American travelers feel COVID will have a meaningful impact on their travel experiences, and fewer than one-in-five recent travelers felt pandemic anxiety on their last trip.

- Interestingly, after more than two years of COVID-19, American travelers do reveal a wariness about the pandemic’s future. Over 45% of American travelers feel it’s likely that a dangerous new variant of COVID-19 will emerge in the U.S. in the remainder of this year. In addition, those that feel the pandemic situation will get worse in the next month has more than doubled over the last several weeks—to 21.5% from 8.7%. However, this wariness has not currently impacted their excitement for travel nor their confidence in their ability to travel safely.

The State of Business Travel

- Nearly two-thirds of of American travelers feel it’s likely companies will require more employees to return to the office in the remainder of the year. However, only 36.5% of American travelers expect that business travel will return to pre-pandemic levels in 2022, as 64.7% believe that virtual meetings will continue to replace many in-person meetings.

- Business travelers are certainly on the road, though. Over half of business travelers will take a business trip in the next 3 months—1.3 of these trips on average.

Leave a Reply