Three in five U.S. adults (62%) expect to take at least one leisure vacation during the next six months.

Prevailing optimism comes out of MMGY Global‘s research and insights division, MMGY Travel Intelligence, has released the Spring Edition of its Portrait of American Travelers® survey, now in its 31st year.

The findings reveal:

- impact on the current economic environment

- prevailing social values

- travel behaviors

- intentions of travelers

- destination preferences

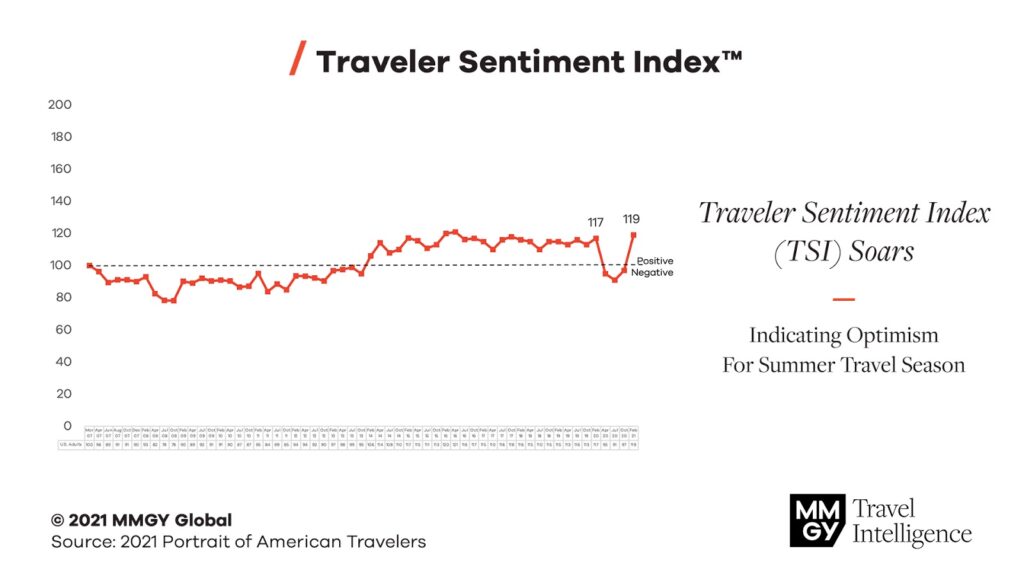

The Traveler Sentiment Index rose to a pre-pandemic level at 119, an indication that people are thinking much more positively about travel than at any time during the previous 12 months.

“It has been a devastating year for the travel industry, but companies have remained incredibly resilient and steadfast in their commitment to meeting travelers’ needs and concerns,” said Chris Davidson, executive vice president of MMGY Travel Intelligence. “The results from the study show that we are already in the midst of an impressive rebound, and travel companies should leverage these insights and use them to guide their strategies in the months ahead.”

Where’s the strongest interest over the next two years?

- Hawaii – 64%

- Florida – 62%

- California – 53%

- Colorado – 50%

- Alaska – 49%

- New York – 49%

The study notes that some destinations – Portland, Seattle and Washington, D.C. – have experienced large decreases in interest, likely the result of extensive political and social unrest that occurred in these destinations throughout the past year. There is some interest in international destinations. However, it remains relatively low with only 19% of leisure travelers indicating that they are likely to take an international trip in the next six months – down from 24% in January 2020.

Travel behavior has changed due to the pandemic, with more road trips than flights than flying, a preference for outdoor destinations over cities. Mode of transportation over the next six months?

- personal car – 62%

- domestic flight – 38%

Who is traveling over the next 6-12 months?

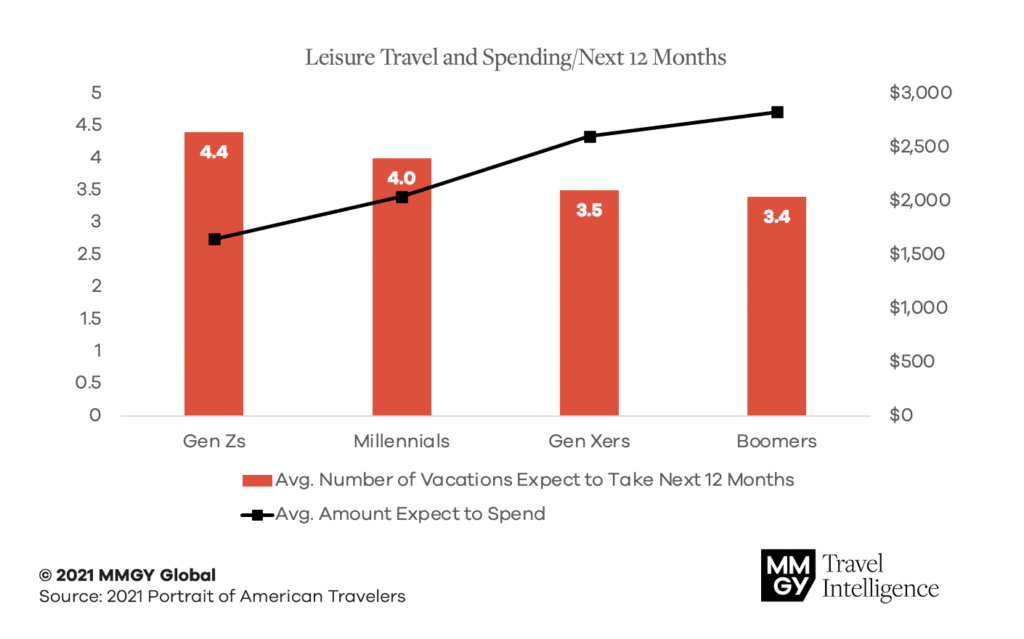

The intent to take a vacation during the next six months decreases with age and increases with household income. Among leisure travelers in the US, the expectation is 3.7 overnight leisure trips in 2021 with an average spend of $2,415 per trip. While Boomers and Gen Xers are taking fewer trips than Millennials and Gen Zs, they’re spending more.

Though travelers are ready to spend on vacations, they are also anticipating travel deals. Perceptions around the affordability of travel have far surpassed pre-pandemic levels (up 29 points), and this metric was the only TSI component that did not take a significant dip throughout the pandemic as travelers expected travel companies to slash prices given reduced demand.

What about the return of corporate travel?

MMGY Global CEO Clayton Reid explains the shift that’s anticipated around rates and fares. “MMGY Global believes the next six months will see a unique environment whereby weekend leisure travel demand is so significant that it pushes leisure demand to weekdays, thereby displacing traditional corporate travel,” Reid said. “We are calling this ‘reverse compression.’ We think trip volume will not only be led by leisure demand but that fare and rate strength will also come first from consumers and second from business, even in market environments and periods where that just doesn’t happen.”

Related: Guest Post: ‘Reverse Compression’ by Clayton Reid, CEO of MMGY Global

Environmental responsibility and sustainability are also addressed, with 83% of active leisure travelers saying they’re open to changing some aspect of their travel behavior in order to reduce impact on the environment. For example, visiting destinations in the off-season to reduce overcrowding and using less single-use plastics while traveling appear to be changes most are willing to make.

About the 2021 Portrait of American Travelers®

MMGY Global’s Portrait of American Travelers® study provides an in-depth examination of the impact on the current economic environment, prevailing social values, and emerging travel habits, preferences and intentions of Americans. Now in its 31st year, it is widely regarded as a leading barometer of travel trends and an essential tool for both the development and evolution of brand and marketing strategy. The travel trend information presented in the report was obtained from interviews with 4,500 U.S. adults in February 2021. The four generations of adults surveyed are Gen Zs (ages 18–23), Millennials (ages 24–39), Gen Xers (ages 40–55), Boomers (ages 56–74) and Silent/GIs (ages 75+). This is the first of four quarterly reports to be released this year. For more information about insights or to purchase Portrait of American Travelers® report, www.mmgyintel.com/products/traveler-profiles.

Leave a Reply