Do you know where to get the latest National Parks visitation data?

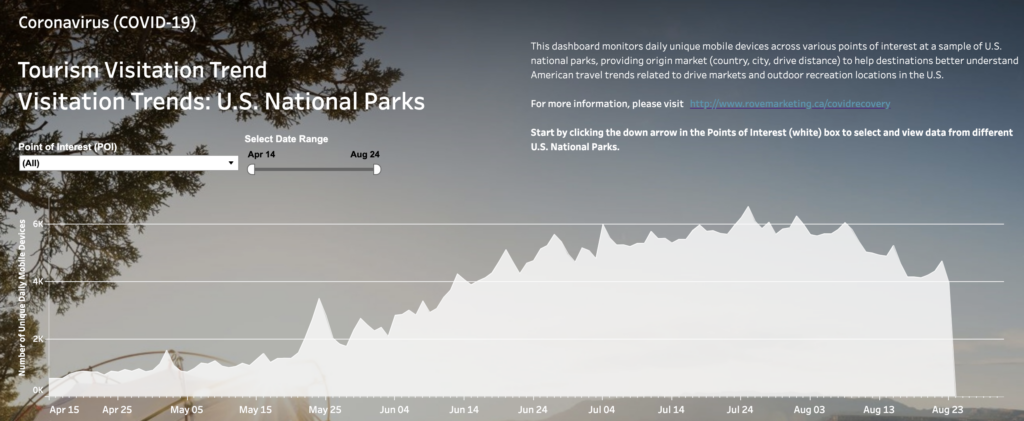

It can serve as a leading indicator to help track the recovery of the domestic travel market from the COVID-19 pandemic. In partnership with US Travel Association, Rove Marketing and Uber Media offer this new cool tool.

Monitor daily unique mobile devices across points of interest at 21 U.S. National Parks and National Park sites from Alcatraz Island to the Statue of Liberty and the Grand Canyon to Acadia National Park. Get data as a representative sample of total visitations to the parks, insights on recent growth trends as well as origin cities and driving distances of visitors.

The interactive dashboard allows allows users to view data (since Jan. 31, 2020) for all National Park Sites at once or to select a specific park or site and/or shorten the date range.

The National Parks Visitation Tableau Dashboard is updated every 10 days.

Key Findings:

1. Locals are fueling the visitation growth in many National Historical Parks, tourists are fueling the visitation growth in National Parks.

2. National Parks such as Glacier, Acadia, Grand Teton, Yellowstone and others are seeing between 80-90% of their visitors driving from over 200 miles away.

3. We see a shuffling in the top 5 DMAs of Origin across several parks suggesting new markets appear to be opening up to travel. This is an encouraging signal helping disperse visitor drive routes and provide more operators/attractions/accommodations a share of the tourism dollar.

Arrivalist’s Daily Travel Index makes a surprising projection, estimating that 42.5 million Americans will hit the road Labor Day weekend to close out the summer. That’s just 5.3% below travel activity from last year. Read more here.

According to the most recent Longwoods International tracking study of American travelers, as we head into the Labor Day holiday weekend, the percentage of those confident in traveling outside their communities jumped to 49%, the highest level since early May. And the percentage of those confident in dining in local restaurants and shopping in local stores is also up to 48%, the highest level since the low of 31% in mid-May. More than two-thirds of American travelers have travel plans in the next six months.

According to the survey, consumer support for opening their communities to visitors also rose to 44%. This too is up from a low of 31% on May 13th.

Key Findings:

- Heading into Labor Day Weekend, traveler confidence is showing positive signs of rebounding

- The percentage of those confident in traveling outside their communities jumped to 49%, the highest level since early May.

- The percentage of those confident in dining in local restaurants and shopping in local stores is also up to 48%, the highest level since the May 13 low of 31%.

- A majority of American travelers indicate they plan on taking a trip in the next six weeks… road trips being most popular!

- Almost 70% of Americans indicate that they plan to travel in the next six months.

- Almost half of American travelers now report feeling safe in traveling outside their communities.

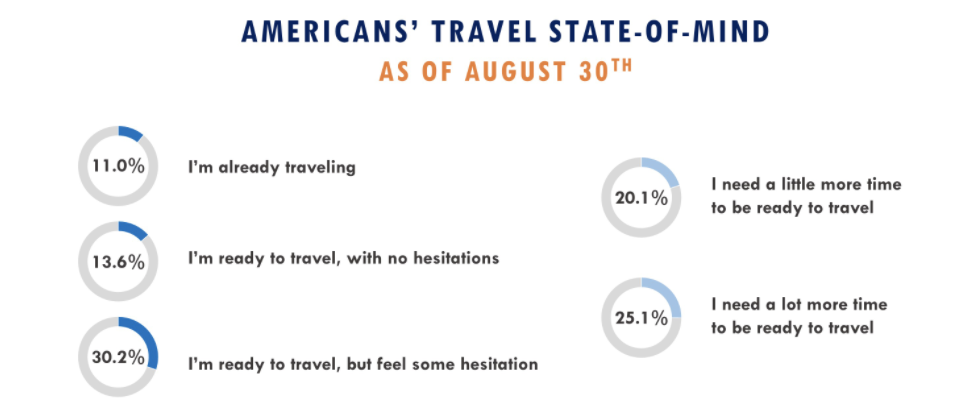

Destination Analysts has released a weekly update on American travel including readiness to travel.

Key Findings:

- American travelers recorded another measured gain in optimism about the pandemic’s course in the next month.

- The perception of travel activities as unsafe is the lowest it has been since June 15.

- Americans have also demonstrated improvement in their state of mind around travel readiness, and Fall travel expectations improved to 35.9% from a low of 29.8% last week.

- Americans prioritization of travel in their personal budgets is growing. Now, 43.0% of American travelers say that leisure travel will be at least a somewhat high priority in their personal budget in the next year and a majority of American travelers say the pandemic has not negatively impacted the disposable income they have available for travel. However, they indeed plan on being more budget conscious on their trips than they were prior to the pandemic.

- Although sentiment is turning more positive, the pandemic is nevertheless still impacting travel at a high rate. 49% of American travelers have cancelled a trip due to COVID-19 and trips for the upcoming national Labor Day and Thanksgiving holidays currently look to be off by half relative to 2019.

- Americans may need more information and assurances to move them to take trips, as 46.1% report that they are “not very” or “not at all” confident that they can travel safely in the current environment. In comparison, 29.7% feel confident or very confident they can travel safely.

- Americans see travel as a means to achieving their desired emotional states, with over a third of American travelers feeling that if they took a trip this year, the emotions most negatively impacted by the pandemic would strengthen.

- When asked how travel marketers could best reach them, email is productive across all generations. Gen X and Boomers appear particularly receptive to search engine marketing right now, while Millennial and younger travelers like travel marketing via Facebook and Instagram.

- Americans with trips planned for the remaining four months of 2020 showed the most enthusiasm for beaches and mountains—the latter notably higher than what was typical pre-pandemic.

American travelers recorded another measured gain in optimism about the pandemic’s course. This week, 23.0% feel the situation in the United States will improve in the next month and 37.2% think it will stay the same. While 39.9% continue to think it will get worse, this is down markedly from 53.7% one month ago. The proportion of American travelers with high degrees of concern for their personal and friends/family’s safety against the virus has dropped back to June levels after being heightened over the last two months while cases surged. However, concerns about the virus’ impact on their personal finances strengthened (60.2% are highly concerned, up from 56.0% last week).

When considering travel, the perception of travel activities as unsafe is the lowest it has been since June 15. Americans have also demonstrated improvement in their state of mind around travel readiness—over half feel in a readiness mindset versus needing more time to feel up to consider it. For the near-term, excitement to take a potential getaway in the next month and openness to travel inspiration levels increased for the second week in a row, and Fall travel expectations improved to 35.9% from a low of 29.8% last week.

Take a look at how a sampling of Americans are responding to a question regarding outdoor activities and winter vacation travel: Outlook for Overnight Ski/Snowboarding Trips This Season.